Editor’s Note 1: This post is sort of a follow-on to Columns #291 and #333, in which I wrote about “unsexy solutions” to some of life’s most widely-faced challenges.

Editor’s Note 2: Both of the links from Editor’s Note 1 are broken right now because I’m in the middle of retroactively “fixing” all my old Columns. Eventually both of those links will work. I’m leaving it for now as incentive for me to finish that project.

The Index Card

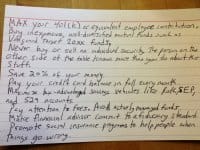

Back in 2013, while promoting her new book, author Helaine Olen said:

The best [financial] advice for most people would fit on an index card - Helaine Olen1

When asked what such an index card would look like, Helaine whipped out a pen, a card, hastily took a picture of it, and produced a viral image:

I love this concept.

This is an application of the Pareto Principle to an entire body of knowledge. Personal finance is, much to my frustration, an incredibly opaque and deep topic. There are volumes and volumes of in-depth analyses of the field from all sorts of sources. There are websites, books, courses, videos, and a whole industry of professional advisors to explain the subject. If you’re a layperson, just getting started is intimidating. For some, too intimidating to even entertain the concept. They just accept their ignorance and hope whatever they’re doing by default is “good enough”.

For those that do attempt to educate themselves, they walk into a familiar situation. Any given article or book will assume the reader has a particular amount of pre-existing knowledge. As the reader, it’s difficult to predict which resources will be “at your level”. So you dip your toe in, you find words like “equity” and “annuity” and then you either double-down on researching or nope right out of there.

Even if you push past that, you’re typically reading in great detail about the bark on a particular tree, when what you really need is to see the layout of the forest. You’ve got a dozen or more tabs open of things you’ve run across and decided you need to read more about, after you’ve figured out what this article is all about.

Enter “The Index Card”…

Yes, it doesn’t take into account edge case situations; and, yes, it’s a rudimentary. That’s the point, though. For 80% of people, this tiny set of advice is enough to take them from “completely ignorant” to “just mostly ignorant” - but with enough knowledge to probably make the right decisions by default. It’s not even an 80/20 situation, it’s better than that. It’s more like 80/1 (~80% of people can benefit from 1% of the advice or knowledge available).

Other Index Card(s)

Personal finance is by no means a unique field. There are many such high-barrier-to-entry bodies of knowledge, with best practices that are known & generally agreed upon by experts in the field, about which people could benefit from a basic, easily consumable set of no-prerequisite-knowledge-needed advice. Something as simple as an index card.

So here goes.

NOTE: I am not a trained/certified expert at ANY of these things. Proceed with caution.

Top 5: Advice “Index Cards”

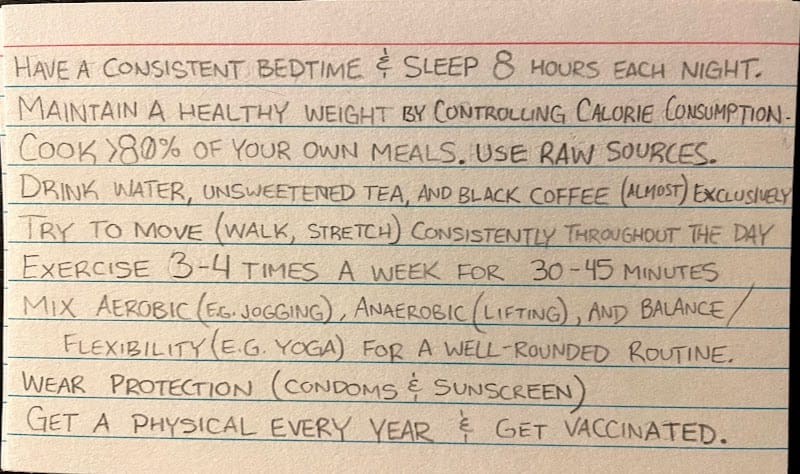

5. Health

Have a consistent bedtime & sleep 8 hours each night.

Maintain a healthy weight by controlling calorie consumption.

Cook >80% of your own meals. Use raw sources.

Drink water, unsweetened tea, and black coffee (almost) exclusively.

Try to move (walk, stretch) consistently throughout the day.

Exercise 3-4 times a week for 30-45 minutes.

Mix aerobic (e.g. jogging), anaerobic (lifting), and balance/flexibility (e.g. yoga) for a well-rounded routine.

Wear protection (condoms & sunscreen).

Get a physical every year & get vaccinated.

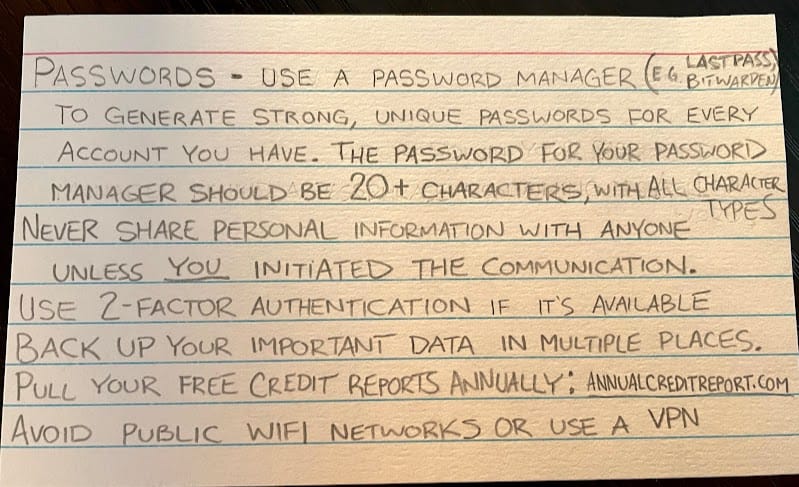

4. Cyber Security

Passwords - use a password manager (e.g. Lastpass, Bitwarden) to generate strong, unique passwords for every account you have. The password for your password manager should be 20+ characters, with all character types.

Never share personal information with anyone unless YOU initiated the communication.

Use 2-factor authentication if it’s available.

Back up your important data in multiple places.

Pull your free credit reports annually: annualcreditreports.com

Avoid public wifi networks or use a VPN.

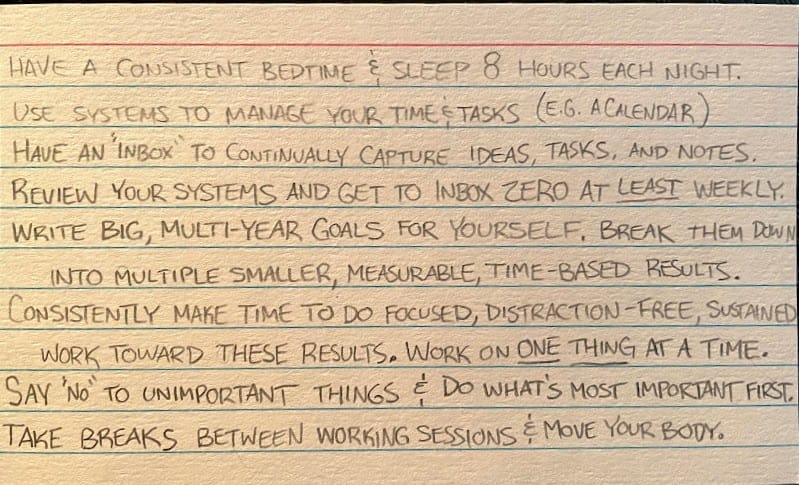

3. Productivity

Have a consistent bedtime & sleep 8 hours each night.

Use systems to manage your time & tasks (e.g. a calendar).

Have an “inbox” to continually capture ideas, tasks, and notes.

Review your systems and get to inbox zero at LEAST weekly.

Write big, multi-year goals for yourself. Break them down into multiple smaller, measurable, time-based results.

Consistently make time to do focused, distraction-free, sustained work toward these results. Work on ONE THING at a time.

Say “no” to unimportant things & do what’s most important first.

Take breaks between working sessions & move your body.

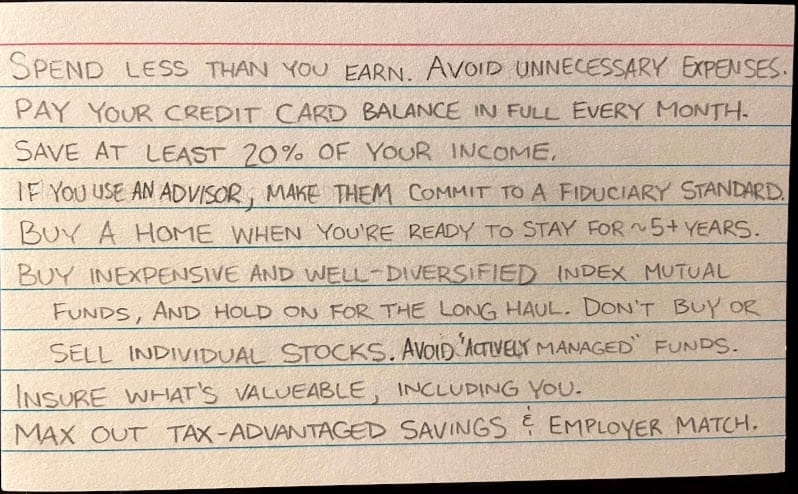

2. Personal Finance1

Spend less than you earn. Avoid unnecessary expenses.

Pay your credit card balance in full every month.

Save at least 20% of your income.

If you use an advisor, make them commit to a fiduciary standard.

Buy a home when you’re ready to stay for ~5+ years.

Buy inexpensive and well-diversified index mutual funds, and hold onto them for the long haul. Don’t buy or sell individual stocks. Avoid “actively managed” funds.

Insure what’s valuable, including you.

Max out tax-advantaged savings & employer match.

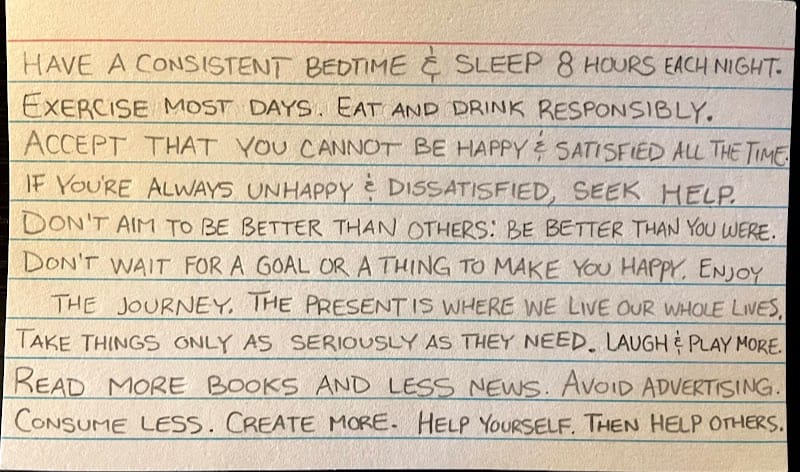

1. Happiness

Have a consistent bedtime & sleep 8 hours each night.

Exercise most days. Eat and drink responsibly.

Accept that you cannot be happy & satisfied all the time.

If you’re always unhappy and dissatisfied, seek help.

Don’t aim to be better than others; be better than you were.

Don’t wait for a goal or a thing to make you happy. Enjoy the journey. The present is where we live our whole lives.

Take things only as seriously as they need. Laugh & play more.

Read more books and less news. Avoid advertising.

Consume less. Create more. Take care of yourself. Then help others.

Quote:

…jingle ball the way… my son